A Tragedy in Several Layoffs

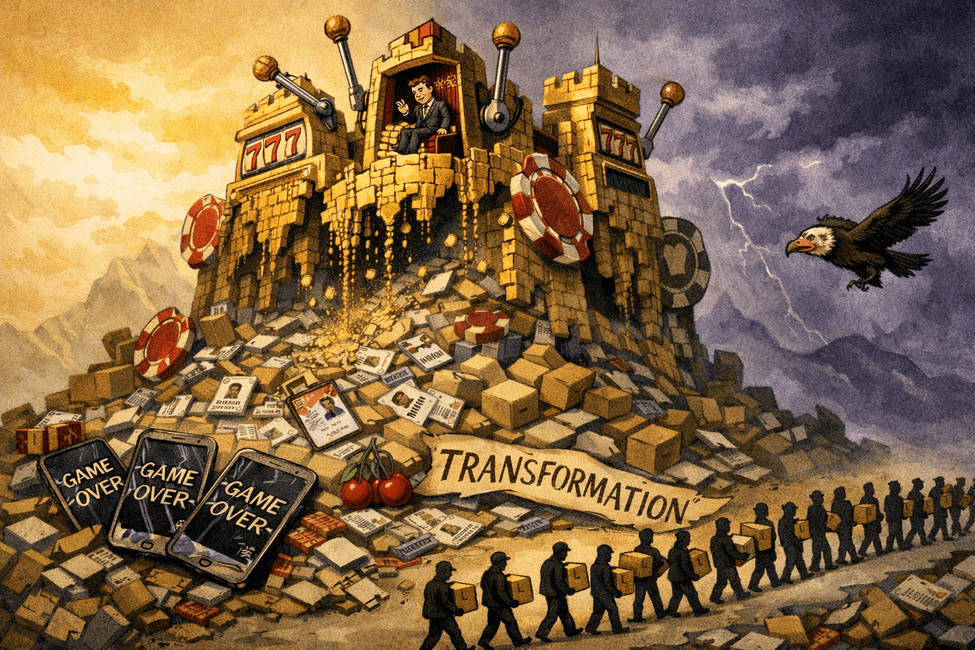

Prologue: Once Upon a Slot Machine 🏰

In the land of mobile gaming, there once rose a mighty kingdom called Coinlandia Interactive. Founded by clever merchants who understood a simple truth: people will pay real money to pull a digital lever and watch digital cherries spin. No prizes. No jackpots. Just the dopamine hit of almost winning, delivered directly to grandma's iPad. It was, as they say in the business, printing money with extra steps.

For a decade, Coinlandia grew fat and magnificent. Their digital slot machines and virtual poker tables attracted millions of devoted subjects—primarily people who remembered when phones had cords and slot machines had handles you could actually pull. The founders built palaces with ocean views, flew thousands of employees to Mediterranean islands for lavish retreats, and spoke at conferences about "the future of entertainment" without once cracking a smile.

But here's the thing about building your empire on elderly gambling habits: those elderly people have a tendency to become more elderly. And when your core demographic starts forgetting where they put their tablets, the wheels of fortune spin in reverse.

What followed was a masterclass in corporate self-destruction so thorough, so methodical, that future MBAs will study it the way medical students study rare diseases. Not to cure them. To identify the symptoms before it's too late.

Chapter 1: The Art of Buying What You Cannot Build 💸

The first alarm bells rang when the kingdom's data priests noticed something troubling: their beloved whales were dying. Not metaphorically. Actually dying. Of old age. The high-spending players who made Coinlandia rich were exiting the demographic—and the mortal plane—at an uncomfortable rate.

"We need younger players!" declared the King. "Innovation! Fresh ideas! Creative vision!"

His advisors stroked their chins. "Your Majesty, we have conducted extensive analysis. Our research indicates that we are world-class at exactly one thing: extracting money from people. Therefore, logically, we should use money to buy the creativity we lack."

The King nodded. After all, creativity is just another resource, like copper or bandwidth. You purchase it, plug it in, and innovation comes out the other end. That's how art works, right?

And so began Coinlandia's legendary acquisition spree—a spending binge so aggressive it made drunken sailors look like Certified Financial Planners.

They bought a beloved German studio. Six hundred million dollars.

They acquired a Finnish puzzle game maker whose cartoon creatures had captured children's hearts worldwide. Two hundred and sixty-nine million dollars.

They purchased a farm simulation company, a home design game developer, a poker studio, and several other creative teams whose founders had made the catastrophic mistake of believing "we want to preserve your creative culture" was anything other than pre-acquisition theater.

Total: billions. Money that could have funded space programs was poured into buying studios whose creative souls would soon be fed into the monetization meat grinder.

Here's the funny thing about buying creativity: it has this annoying habit of walking out the door when it realizes you don't actually want creativity.

You just want slot machines with better graphics.

Chapter 2: The Ruthless and the Impatient 🔪

The acquired studios discovered their new overlords had a singular obsession: monetization. Every creative meeting ended the same way:

"Beautiful concept art. Quick question—where do users buy more coins?"

"Interesting narrative arc. Have we considered adding a loot box at the moment of maximum player vulnerability?"

The founders of one beloved studio—creators of a puzzle game downloaded by over one hundred million people—eventually snapped. They didn't just leave. They denounced. Publicly. They called Coinlandia's leadership "ruthless" and "impatient." They accused the kingdom of "killing efforts to develop new games" and "focusing solely on monetization."

That's not a Glassdoor review. That's a professional death certificate. Notarized and framed.

The kingdom's response: they laid off the entire studio anyway. Can't complain if you don't work here anymore. Problem solved.

The six-hundred-million-dollar home design studio? Founders fled within twenty-four months. That's how long it took to decide no amount of money was worth watching their life's work get gutted for microtransaction revenue.

Those founders didn't just leave—they went on to thrive elsewhere. Some started studios that now compete directly against the company that drove them away. Coinlandia had become a training ground for the competition. They'd spent billions creating enemies.

This became the Coinlandia Method™:

- Acquire creative studio for hundreds of millions

- Demand immediate monetization improvements

- Watch creative talent resign in disgust

- Wonder why innovation never happens

- Acquire another creative studio

- Repeat until stock price resembles your IQ

Chapter 3: The Revolutionary Decision to Stop Trying 🚫

Then came the announcement that would have been brilliant satire if it weren't a real press release.

"We are temporarily suspending new game development," declared the kingdom's treasurer, "until the return on investment for new games is economically viable."

A gaming company announced it would stop making games because making games wasn't profitable enough.

This is like a restaurant announcing they'll stop cooking food until eating becomes more financially attractive.

But here's where comedy becomes farce: in the same year they suspended internal development, Coinlandia spent four hundred and fifty million dollars acquiring external studios.

"We can't afford to make games ourselves, but we CAN afford to spend half a billion dollars buying other people's games."

The corporate equivalent of saying you're too broke to cook dinner while ordering DoorDash from five restaurants.

Meanwhile, teams of three people with laptops were creating viral hits. These tiny studios didn't have procurement processes or seventeen approval layers. They just made things people enjoyed.

Coinlandia noticed. They tried to buy the legendary bird-flinging franchise—over seven hundred million dollars offered. The bird company looked at Coinlandia's track record and said: "We would rather sell to literally anyone else."

And they did. A competitor scooped them up while Coinlandia stood with checkbook open, wondering why nobody wanted their money anymore.

The kingdom's reputation had spread like a health department warning.

Chapter 4: The Blockchain Detour 🪙

Before the layoffs (oh, we're definitely getting to the layoffs), a brief intermission: Coinlandia's Web3 adventure.

In 2022, when cryptocurrency enthusiasts still insisted digital monkeys would revolutionize art, Coinlandia announced they were exploring blockchain gaming. They hired a "blockchain expert" to lead the charge.

"Web3 feels like a natural extension of our mobile gaming business," they declared, confusing "natural extension" with "desperate flailing toward whatever buzzword investors are excited about."

Two years later: nothing. No blockchain games. No NFT marketplace. Nothing but quiet admission that maybe it hadn't worked out.

The blockchain expert? Gone.

The Web3 initiative? Shelved so quietly you could hear it gathering dust.

Lessons learned? Absolutely none, judging by what came next.

Chapter 5: The Sacred Ritual of the Layoff ✂️

Unable to innovate and increasingly unable to acquire, Coinlandia discovered their one remaining strategic option: firing people. Not just firing—ritual sacrifice with ceremonial regularity.

The Spring Purge: Fifteen percent of the workforce. Six hundred souls. The King announced this would enable "excellence through agility and creativity." The irony of firing six hundred people to achieve creativity escaped everyone in the boardroom.

The Winter Cleansing: Another round. Different geography—Eastern European offices. Same corporate poetry. "Aligning organizational structure with strategic priorities." Translation: fired, but in a strategically aligned way.

The Summer Harvest: Ten percent more. The announcement praised remaining employees for their "resilience and commitment to transformation." Being thanked for not being fired yet is a special kind of corporate love language.

The Autumn Reckoning: Twenty percent. Seven to eight hundred jobs.

Between major purges came smaller cullings. Studios shuttered. Countries exited. Each announcement promised this would be the final transformation needed.

It was never the final transformation.

Total body count across multiple years: north of two thousand jobs. Two thousand people with mortgages and families and the naive belief that working hard meant something.

None of it helped. Revenue kept declining. Stock kept falling. The layoffs continued, as if eventually, firing enough people would cause the survivors to spontaneously develop creative abilities that had been systematically driven away.

Chapter 6: Failure Without Consequence 👔

While thousands of workers were escorted out carrying boxes, something fascinating happened at the top: nothing. The executive layer remained intact, accumulating management levels like geological sediment.

Individual Contributors → Team Leads → Managers → Senior Managers → Directors → Senior Directors → Vice Presidents → Senior Vice Presidents → Executive Vice Presidents → C-Suite → The King

Each layer existed to approve decisions from below and forward status reports above. Actual game development happened somewhere in this structure, presumably, though no one at the top seemed sure where.

Eventually, Coinlandia eliminated two C-suite positions entirely: Chief Revenue Officer and Chief Operating Officer. Gone. The King would personally oversee these functions.

This was presented as bold leadership.

It was an admission they'd been paying millions annually for positions that didn't need to exist.

One investment fund conducted due diligence on a potential buyout, then withdrew—publicly citing "significant governance deficiencies" and "conflicts of interest."

When the vultures circle your company and fly away in disgust, the problem isn't the market. The problem is the corpse.

Chapter 7: The Machinery of Rational Destruction ⚙️

Here's what makes this story genuinely tragic rather than merely stupid: inside the boardroom, every decision felt rational.

The quarterly earnings treadmill demanded growth metrics every ninety days. Acquiring studios produced immediate revenue bumps that satisfied analysts. Developing games internally took years with uncertain returns—poison for a public company's stock price.

Executive compensation was tied to short-term performance. Stock options vested on eighteen-month schedules. Performance bonuses triggered on quarterly EBITDA targets. The leaders making decisions would cash out long before the long-term damage became visible. By the time the acquired studios collapsed or the layoffs failed to reverse decline, the executives who made those calls had already converted their equity into beach houses.

"Transformation" became the only acceptable vocabulary because it was the only strategy that didn't require admitting failure. You're not declining—you're transforming. You're not lost—you're pivoting. You're not destroying value—you're "aligning organizational structure with strategic priorities."

The system didn't produce villains. It produced rational actors responding to irrational incentives. The executives weren't stupid. They were optimizing for exactly what they were paid to optimize for.

That's the horror. Not that bad people made bad decisions, but that the machinery of public markets, quarterly capitalism, and executive compensation manufactured these outcomes automatically.

The kingdom didn't fall because of evil. It fell because of design.

Chapter 8: The Stock Price Discovers Gravity 📉

When Coinlandia went public, timing seemed divinely ordained. A pandemic had trapped humanity indoors, willing to spend money on anything providing momentary distraction. Digital slot machines? Sure. Anything to forget the world was burning.

IPO price: twenty-seven dollars. Within months, it climbed past thirty-two. Analysts wrote glowing reports. The founders became paper billionaires.

Then the pandemic ended. People went outside. They remembered other entertainment existed.

The stock descended. And descended. And descended.

From an all-time high of thirty-two dollars to three-fifty. Not thirty-five. Three dollars and fifty cents. An eighty-nine percent decline. Nearly ninety percent of the company's value—gone. If you'd invested your retirement savings at the peak, congratulations—you now have eleven cents left for every dollar you trusted them with.

Each layoff brought fresh selling. The market interpreted "workforce reduction" not as fiscal discipline, but as evidence the patient was still bleeding.

Cut costs → Stock drops → Cut more costs → Stock drops more.

The kingdom's response: announce more layoffs and a commitment to artificial intelligence. "We must leverage AI to do more with less"—what every failing company says when they've given up on what made their products worth buying: human creativity.

Chapter 9: The Prophecy of Transformation 🔮

With each layoff round, the King issued proclamations of renewal:

"Our broad growth mindset is no longer sustainable." (We failed at growth, so now we're calling failure sustainability.)

"We need fewer layers, smaller teams, and sharper focus." (The same thing we said last time, and the time before.)

"Transformation requires difficult decisions." (Difficult for you. We'll be fine.)

These phrases had been recycled so many times they'd lost all meaning. Corporate incantations—magic words to make layoffs sound like strategy rather than surrender.

Meanwhile, the studios Coinlandia failed to buy—or bought and destroyed—continued to flourish. They made games people loved. They built communities that felt valued rather than monetized. They innovated because they wanted to, not because a board demanded metrics.

They didn't have Coinlandia's resources. They just had talent, vision, and freedom to pursue both without someone asking "but where do users buy more coins?"

Epilogue: The Moral of the Story 🪦

You cannot buy innovation. Creativity requires freedom, trust, and time. When you purchase a studio and immediately demand monetization metrics, you're buying a corpse and expecting it to dance.

Layoffs are not a strategy. They are an admission your actual strategy failed. The sixth transformation is not more real than the first five. It's just more desperate.

Systems produce outcomes. The executives weren't uniquely evil. They were responding rationally to a structure that rewarded quarterly performance over long-term health. The machinery of public markets manufactured this disaster automatically. That's the real horror.

So here stands Coinlandia: profitable on paper, hemorrhaging talent and trust in practice.

The founders still have their ocean-view palaces. The C-suite still collects compensation. The shareholders who got out early still count their gains.

And everyone else learned what leadership never had to learn: in the kingdom of the coin-eaters, the house always wins.

The house just isn't yours.

The transformation continues.

🎰 🎰 🎰

This has been a Codyssey Original Where Technical Reality Meets Satirical Truth

Author's Note: Any resemblance to actual gaming companies is purely coincidental and absolutely deliberate. Names changed to protect the guilty, who remain untroubled by guilt.